Market power

| Competition law |

|---|

| Basic concepts |

| Anti-competitive practices |

| Enforcement authorities and organizations |

In economics and particularly in industrial organization, market power is the ability of a firm to profitably raise the market price of a good or service over marginal cost. In perfectly competitive markets, market participants have no market power. A firm with total market power can raise prices without losing any customers to competitors. Market participants that have market power are therefore sometimes referred to as "price makers" or "price setters", while those without are sometimes called "price takers". Significant market power occurs when prices exceed marginal cost and long run average cost, so the firm makes economic profits.

A firm with market power has the ability to individually affect either the total quantity or the prevailing price in the market. Price makers face a downward-sloping demand curve, such that price increases lead to a lower quantity demanded. The decrease in supply as a result of the exercise of market power creates an economic deadweight loss which is often viewed as socially undesirable. As a result, many countries have anti-trust or other legislation intended to limit the ability of firms to accrue market power. Such legislation often regulates mergers and sometimes introduces a judicial power to compel divestiture.

A firm usually has market power by virtue of controlling a large portion of the market. In extreme cases—monopoly and monopsony—the firm controls the entire market. However, market size alone is not the only indicator of market power. Highly concentrated markets may be contestable if there are no barriers to entry or exit, limiting the incumbent firm's ability to raise its price above competitive levels.

Market power gives firms the ability to engage in unilateral anti-competitive behavior.[1] Some of the behaviours that firms with market power are accused of engaging in include predatory pricing, product tying, and creation of overcapacity or other barriers to entry. If no individual participant in the market has significant market power, then anti-competitive behavior can take place only through collusion, or the exercise of a group of participants' collective market power.

The Lerner index and Herfindahl index may be used to measure market power.

Contents

Oligopoly

When several firms control a significant share of market sales, the resulting market structure is called an oligopoly or oligopsony. An oligopoly may engage in collusion, either tacit or overt, and thereby exercise market power. A group of firms that explicitly agree to affect market price or output is called a cartel.

Monopoly power

Monopoly power is an example of market failure which occurs when one or more of the participants has the ability to influence the price or other outcomes in some general or specialized market. The most commonly discussed form of market power is that of a monopoly, but other forms such as monopsony, and more moderate versions of these two extremes, exist.

A well-known example of monopolistic market power is Microsoft's market share in PC operating systems. The United States v. Microsoft case dealt with an allegation that Microsoft illegally exercised its market power by bundling its web browser with its operating system. In this respect, the notion of dominance and dominant position in EU Antitrust Law is a strictly related aspect.[2]

Source of market power

A monopoly can raise prices and retain customers because the monopoly has no competitors. If a customer has no other place to go to obtain the goods or services, they either pay the increased price or do without.[3] Thus the key to market power is to preclude competition through high barriers of entry. Barriers to entry that are significant sources of market power are control of scarce resources, increasing returns to scale, technological superiority and government created barriers to entry.[4] OPEC is an example of an organization that has market power due to control over scarce resources — oil. Increasing returns to scale are another important source of market power. Firms experiencing increasing returns to scale are also experiencing decreasing average total costs.[5] Firms in such industries become more profitable with size.[6] Therefore over time the industry is dominated by a few large firms. This dominance makes it difficult for start up firms to succeed.[7] Firms like power companies, cable television companies and wireless communication companies with large start up costs fall within this category. A company wishing to enter such industries must have the financial ability to spend millions of dollars before starting operations and generating any revenue.[8] Similarly established firms also have a competitive advantage over new firms. An established firm threatened by a new competitor can lower prices to drive out the competition. Microsoft is a firm that has substantial pricing or market power due to technological superiority in its design and production processes.[9] Finally government created barriers to entry can be a source of market power. A prime example are patents granted to pharmaceutical companies. These patents give the drug companies a virtual monopoly in the protected product for the term of the patent.

Measuring market power

Concentration ratios are the most common measures of market power.[10] The four-firm concentration ratio measures the percentage of total industry output attributable to the top four companies. For monopolies the four firm ratio is 100 per cent while the ratio is zero for perfect competition.[11] The four firm concentration domestic (U.S) ratios for cigarettes is 93%; for automobiles, 84% and for beer, 85%.[12]

Another measure of concentration is the Herfindahl-Hirschman Index (HHI) which is calculated by "summing the squares of the percentage market shares of all participants in the market." [13] The HHI index for perfect competition is zero; for monopoly, 10,000.

U.S. courts almost never consider a firm to possess market power if it has a market share of less than 50 percent.[14]

Market power and elasticity of demand

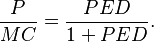

Market power is the ability to raise price above marginal cost and earn a positive profit.[15] The degree to which a firm can raise price above marginal cost depends on the shape of the demand curve at the profit maximizing output.[16] That is, elasticity is the critical factor in determining market power. The relationship between market power and the price elasticity of demand (PED) can be summarized by the equation:

Note that PED will be negative, so the ratio is always greater than one. The higher the P/MC ratio, the more market power the firm possesses. As PED increases in magnitude, the P/MC ratio approaches one, and market power approaches zero.[17] The equation is derived from the monopolist pricing rule:

Nobel Memorial Prize

Jean Tirole was awarded the 2014 Nobel Memorial Prize in Economic Sciences for his analysis of market power and economic regulation.

See also

- Bargaining power

- Imperfect competition

- Market concentration

- Monopsony

- Natural monopoly

- Predatory pricing

- Price discrimination

- Dominance (economics)

References

- ↑ Vatiero Massimiliano (2010), "The Ordoliberal notion of market power: an institutionalist reassessment", European Competition Journal, 6(3): 689–707.

- ↑ Vatiero M. (2009), "An Institutionalist Explanation of Market Dominances". World Competition. Law and Economics Review, 32(2):221–226.

- ↑ If the power company raised rates the customer either pays the increase or does without power.

- ↑ Krugman & Wells, Microeconomics 2d ed. (Worth 2009)

- ↑ Krugman & Wells, Microeconomics 2d ed. (Worth 2009)

- ↑ Krugman & Wells, Microeconomics 2d ed. (Worth 2009)

- ↑ Krugman & Wells, Microeconomics 2d ed. (Worth 2009)

- ↑ Often such natural monopolies will also have the benefit of government granted monopolies.

- ↑ Krugman & Wells, Microeconomics 2d ed. (Worth 2009)

- ↑ Samuelson & Nordhaus, Microeconomics, 17th ed. (McGraw-Hill 2001) at 183–184.

- ↑ Samuelson & Nordhaus, Microeconomics, 17th ed. (McGraw-Hill 2001) at 183.

- ↑ Samuelson & Nordhaus, Microeconomics, 17th ed. (McGraw-Hill 2001) at 184.

- ↑ Samuelson & Nordhaus, Microeconomics, 17th ed. (McGraw-Hill 2001) at 184.

- ↑ J. Gregory Sidak & Hal J. Singer, Überregulation Without Economics: The World Trade Organization’s Decision in the U.S.-Mexico Arbitration on Telecommunications Services, General Agreement on Trade in Services, GATS, 57 FED. COMM. L.J. 1, 34 (2004), http://www.repository.law.indiana.edu/cgi/viewcontent.cgi?article=1388&context=fclj.

- ↑ Perloff, J: Microeconomics Theory & Applications with Calculus page 369. Pearson 2008.

- ↑ Perloff, J: Microeconomics Theory & Applications with Calculus page 369. Pearson 2008.

- ↑ Perloff, J: Microeconomics Theory & Applications with Calculus Pearson 2008.

Further references

- Managerial Economics and Organizational Architecture 3rd Edition, Brickley, Smith and Zimmerman, McGraw-Hill, Chapter 7.

- "The Theory of Industrial Organization", Tirole, MIT Press 1988