751

Reversal pattern chart

Discover Pinterest’s best ideas and inspiration for Reversal pattern chart. Get inspired and try out new things.

187 people searched this

·

Last updated 1d

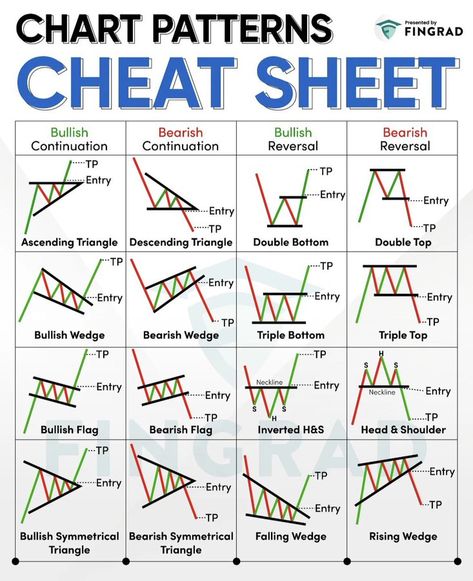

Here some are importnat chart patterns With help of them you can bright your trading carior.

164

✅ Bullish reversal patterns are formations that suggest a change in the prevailing trend from down to up. -These patterns can be found on price charts and are used by technical analysts to help predict future price movements. -The three most common bullish reversal patterns are the head and shoulders, the inverted head and shoulders, and the double bottom. 📌 I have created a helpful 3-step course for all new traders called the Equity & Options MasterClass 🔗Grab it on my website (Link in Bi

824

1.2k

A double bottom formation is a bullish reversal pattern that occurs when the price of an asset hits a support level twice and then reverses upward. It can be identified by two troughs that form at approximately the same level, with a peak in between them. The pattern is complete when the price breaks above the peak between the two troughs, indicating a potential trend reversal.

36

530

946

Forex Trading #forextrading #forextrading #strategies #trading #trader #stock #market #cryptocurrency #crypto #bitcoin #trading #forex @forexhq @forexedukacja @Forex_Market_Empire

180

On the technical analysis chart, the head and shoulders formation occurs when a market trend is in the process of reversal either from a bullish or bearish trend; a characteristic pattern takes shape and is recognized as reversal formation.

839

✅ The Double Top pattern can be used to find good sell positions. - When the 'M' formation is formed, - it is a sign of reversal as the price of a currency or asset has also rejected the same area twice consecutively. - When using chart patterns always look for multiple confluences to increase trade accuracy. 📌 I have created a helpful 3-step course for all new traders called the Equity & Options MasterClass . It's the top 5 Setups which has over only 3% loosing ratio ! That means it has 9

480

2.8k

Chart Patterns Cheat Sheet.pdf - Free download as PDF File (.pdf), Text File (.txt) or read online for free. This document provides a cheat sheet of common chart patterns in technical analysis. It lists reversal patterns like double tops and head and shoulders that indicate a change in trend. Continuation patterns like falling and rising wedges suggest the trend will continue. Bilateral patterns including ascending, descending, and symmetrical triangles can be either reversal or continuation…

4.4k

2.2k

📈 Master Chart Pattern Reversals with Our Cheat Sheet 📉 Understanding reversal patterns is key to identifying potential trend changes in the market. Use this guide to familiarize yourself with both bearish and bullish reversal patterns: Bearish Reversal Patterns:

- Bearish Double Top

- Bearish Head and Shoulders

- Bearish Rising Wedge

- Bearish Expanding Triangle

- Bearish Triple Top Bullish Reversal Patterns:

- Bullish Double Bottom

- Bullish Inverted Head and Shoulders

- Bullish…

7

Cup & Handle pattern

861

Candlestick patterns indicators guide you about candle next target in term of analysis. Candlestick pattern chart is most power idea for trading and play key role in turning points in any market pair. You also can understand complete about candlestick chart PDF for more details with trading role and daily market trend analysis in Forex.

20

Candlestick patterns are powerful tools for traders, helping them predict market movements with accuracy. In this guide, we explore the most important candlestick formations, from bullish and bearish patterns to reversals and continuations. Learn how to read candlestick charts, identify profitable trading opportunities, and avoid common mistakes. Whether you're a beginner or an experienced trader, mastering candlestick patterns can give you a strategic edge in the market

898

Here are some common chart patterns that are important to know for traders and investors. These include bilateral patterns, reversal patterns, continuation patterns, and more if you click the image

101

This post will show you all the top chart patterns you need to know if you're getting into trading. History repeats itself. This is true in life and in the stock market as well. That's why chart patterns exist in stock trading. Over the years, we've seen basically every single kind of chart pattern many times. They don't always go according to plan, sometimes chart patterns will break down, but often times they will work. Check out the post to learn more. #stocks #trading #invest…

8

Learn to identify trends and trend reversals in the market. Understand the market's two types of trends: uptrend and downtrend. #forex #trading #forextrading #stocks #investing #finance #forexmarket #daytrading #trader #currencies #fx #forextrader #technicalanalysis

211

Related interests

Reversal pattern chart and more