PayPal Statistics By Revenue, Growth, Users, Demographics And Corporate

Updated · Jan 16, 2025

TABLE OF CONTENTS

- Introduction

- Editor’s Choice

- What is PayPal?

- General PayPal Statistics

- PayPal Revenue Statistics

- PayPal Growth Statistics

- eCommerce And PayPal Statistics

- PayPal Users Statistics

- PayPal Demographics Statistics

- Competitors of PayPal Statistics

- Profit Earned By PayPal Statistics

- PayPal Corporate Statistics

- Conclusion

Introduction

PayPal Statistics: PayPal is a global financial technology company that operates an online payment system that allows people to transfer money online. It also works with payment processors for various auction sites, online sellers, and businesses, charging a fee for these services. PayPal provides a digital payment option as an alternative to traditional methods like money orders and checks. If you’re considering opening a PayPal account or already have one, this guide will help you understand PayPal’s statistics. It’s both informative and eye-opening.

As one of the most popular payment apps, PayPal holds a significant market share of 42% worldwide. In the late 1990s, buying things online was not very trusted, as there was no guarantee that the items would be delivered or that any payment errors would be refunded. We shall shed more light on PayPal Statistics through this article.

Editor’s Choice

- In 2024, PayPal has over 429 million active accounts, up from 391 million at the end of 2023.

- PayPal processes payments for nearly 20 million websites globally.

- In 2023, PayPal’s total payment volume (TPV) reached a record USD 1.53 trillion, with 24.981 billion transactions.

- The average PayPal user completed 58.7 transactions in 2024.

- PayPal holds over 45% of the online payment processing market.

- Around 35 million merchants use PayPal to accept payments worldwide.

- The fastest-growing PayPal user group is individuals over 50 years old.

- In the U.S., about 9% of children reportedly have a PayPal account.

- PayPal’s revenue in 2023 totaled USD 29.8 billion, an 8.19% year-over-year increase, with a net income of USD 4.25 billion.

What is PayPal?

PayPal Holdings, Inc. is an American multinational company that offers an online payment system that enables people to send money in most countries. It serves as a digital alternative to traditional payment methods like checks and money orders. PayPal also processes payments for online sellers, auction websites, and other businesses, charging a fee for these services.

PayPal was founded in 1998 as Confinity and became publicly traded in 2002. That same year, eBay purchased PayPal for $1.5 billion. In 2015, eBay separated from PayPal, making it an independent company again. In 2022, PayPal was ranked 143rd on the Fortune 500 list of the largest U.S. companies by revenue. Since 2023, PayPal has been a member of the MACH Alliance.

General PayPal Statistics

- PayPal has 432 million active users and 35 million active businesses using its platform.

- In the third quarter of 2024, PayPal handled about 6.6 billion transactions, with a total of $423 billion in payment volume. For that same period, PayPal earned $7.8 billion in revenue, which is a 6% increase compared to the previous year.

- PayPal Statistics stated that PayPal controls 45.4% of the online payment processing market. It operates in over 200 countries and supports 25 different currencies.

- As of March, PayPal has between 433 million and 435 million active accounts.

- PayPal’s earnings are expected to grow by 7.5%.

- The company controls 42% of the global market share in the payment services industry.

- In 2023, PayPal processed a total of $1.49 trillion in payments.

- In the first quarter of 2023, PayPal had an average of 53.1 transactions per account, showing a 13% growth compared to the previous year.

- Most of PayPal’s revenue, 90.4%, came from transactions, while 9.6% came from additional services.

- By the end of March 2023, PayPal had processed 5.8 billion transactions, a 13% increase from the year before.

(Source: chargeback.io)

- In 2023, around 29 million merchants were expected to have accounts on PayPal.

- PayPal operates in over 200 countries and territories worldwide.

- As of 2023, PayPal employed 30,817 people.

- PayPal Statistics stated that customers are 54% more likely to purchase from a business that accepts PayPal.

- In the first quarter of 2023, PayPal’s revenue grew to $7.04 billion, compared to $6.48 billion in the same quarter of the previous year.

- By March 2023, PayPal had 433 million active accounts.

- PayPal’s earnings fell to $2.4 billion in 2022, down from $4.1 billion in 2021.

- Most of PayPal’s revenue, 90.4%, comes from transaction fees.

- In the first quarter of 2023, the average PayPal user made 53.1 transactions.

- PayPal has the largest market share in global payment processing, holding nearly 42%.

PayPal Revenue Statistics

- As of June 2024, PayPal’s revenue is $7.89 billion, with a net income of $1.13 billion. This gives PayPal a net profit margin of 14.31%.

- Compared to September 2023, this is a 5.96% increase from their $7.42 billion revenue and a 10.78% increase from their $1.02 billion net income.

- In 2023, PayPal earned $29.771 billion in revenue, which is an 8.19% increase from $27.51 billion in 2022.

- PayPal’s gross revenue is 91% higher than Stripe’s $14.4 billion in 2022. However, PayPal’s net income in 2022 was $2.149 billion, which is 32% lower than Stripe’s $3.2 billion for the same year.

(Reference: capitaloneshopping.com)

- Here is the PayPal’s revenue through the years:

| Year | Revenue (in Billions) |

|

2010 |

USD 3.5 |

| 2011 |

USD 4.5 |

|

2012 |

USD 6 |

| 2013 |

USD 6.7 |

|

2014 |

USD 8 |

| 2015 |

USD 9.2 |

|

2016 |

USD 10.8 |

| 2017 |

USD 13 |

|

1018 |

USD 15.4 |

| 2019 |

USD 17.7 |

|

2020 |

USD 21.4 |

| 2021 |

USD 25.3 |

|

2022 |

USD 27.5 |

| 2023 |

USD 29.7 |

- PayPal’s net income dropped by over 70% after the pandemic ended in 2022, but it started to recover in 2023.

Here are some key revenue facts for PayPal:

- In Q2 2024, PayPal handled 26 billion transactions.

- The transaction volume for that quarter was $403.9 billion, which is an 11% increase compared to the same time last year.

- PayPal’s international revenue grew slightly, with a 0.58% increase in international transaction revenue from Q4 2022 to Q4 2023.

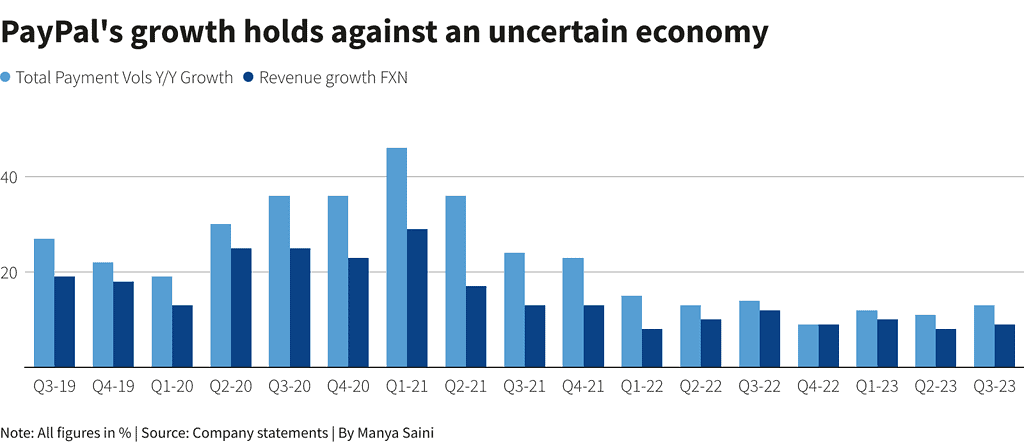

PayPal Growth Statistics

- As of now, PayPal holds the leading position in online payment processing with a 45% market share. It is the most popular choice for online, mobile, and peer-to-peer payments.

- PayPal Statistics stated that around 36 million merchants in more than 165 countries use PayPal, showing a growth rate of 10.76% annually over the last five years.

- In Q4 2023, PayPal processed 6.8 billion business transactions, a 13% increase from the previous year, exceeding the expected 6.7 billion transactions.

- On average, an active PayPal user completes 58.7 transactions a year, which is a 14.2% increase compared to the previous year, higher than the estimated 56 transactions.

- Currently, 426 million accounts are using PayPal, showing a small 0.5% decline compared to the previous quarter.

- Over the last five years, consumer accounts have grown by 9.71% per year, making up 91.8% of all active accounts.

(Source: reuters.com)

- PayPal is used more often for online payments in Germany and Brazil than in the U.S. Between April 2022 and March 2023, almost half of German consumers used PayPal for in-store or restaurant payments, and 90% used it for online purchases.

- Even though PayPal’s global user count dropped in 2023, Germany was its best market last year.

- PayPal Statistics stated that about one-third of websites that offer PayPal as a payment option at checkout are in the United States.

- PayPal saw its highest market adoption in December 2023 in Germany, the UK, Australia, and Austria.

- Compared to other payment processors, PayPal is the leader, with Stripe holding 21% of the market share, followed by Shop Pay.

- 85% of PayPal users are millennials.

eCommerce And PayPal Statistics

- PayPal has transformed the eCommerce industry with its easy online payment solutions and digital products.

- The payment sector is going through big changes due to new rules and innovations in fintech.

- Mobile wallets are expected to make up more than 50% of all eCommerce transactions by 2026.

- PayPal is set to benefit from these changes with its focus on fast, easy payment systems for peer-to-peer transactions, online shopping, and mobile payments.

- Businesses that use PayPal have 25% higher conversion rates compared to those that don’t.

- Large companies using PayPal see 33% more completed checkouts than businesses using traditional payment methods.

(Source: statista.com)

- Shoppers who use PayPal spend 12% more than those using other payment options. PayPal users also buy 60% more often than other online shoppers.

- PayPal has grown its payment solutions with digital products like Venmo, Xoom, Paidy, Honey, and Zettle, which target trends like peer-to-peer payments, buy now, pay later (BNPL), social shopping, and mobile payments.

- PayPal Statistics stated that Venmo now has over 90 million active users in the U.S. and is especially popular with younger, mobile, and social users.

- About 26% of Venmo users are between 18 and 29 years old, and 30% are between 30 and 39.

- Since launching in November 2020, PayPal’s Pay Later option has seen a massive 867% increase in global purchases.

- PayPal’s BNPL solution has driven over twice as many purchases compared to their regular checkout method.

- In its biggest purchase, PayPal bought the browser extension Honey for around $4 billion.

- The goal was to make online shopping and payments simpler and help merchants increase sales.

- PayPal also recently introduced new checkout options and a guest checkout feature, along with a consumer app that offers cash back, to strengthen its position as a leader in payments.

- Currently, PayPal has 1.07 billion shares of outstanding stock. Also, PayPal’s launch of a U.S. dollar-backed stablecoin called PYUSD led to an investigation by the SEC in November 2023.

PayPal Users Statistics

(Reference: oberlo.com)

- As of Q2 2024, PayPal has 429 million users around the world, which is a small 0.5% drop from the previous year.

- Between 2010 and 2023, the number of PayPal users grew by an average of 12.5% each year.

- The largest growth happened in 2020 when PayPal’s user count increased by 23.6%.

| Year | No. of active PayPal accounts (in Q4 of every year unless otherwise instructed) | Annual change |

|

2024 |

429.0 million | -0.5% |

| 2023 | 426.0 million |

-2.1% |

|

2022 |

435.0 million | +2.1% |

| 2021 | 426.0 million |

+13.0% |

|

2020 |

377.0 million | +23.6% |

| 2019 | 305.0 million |

+14.2% |

|

2018 |

267.0 million | +16.2% |

| 2017 | 229.0 million |

+16.2% |

|

2016 |

197.0 million | +10.1% |

| 2015 | 179.0 million |

+10.8% |

|

2014 |

161.5 million | +13.3% |

| 2013 | 142.6 million |

+16.2% |

|

2012 |

122.7 million | +15.4% |

| 2011 | 106.3 million |

+12.6% |

|

2010 |

94.4 million |

– |

- As of Q2 2024, PayPal has 429 million active users worldwide, based on the number of registered accounts. This represents a small 0.5% decrease compared to the same time last year, but it shows a slight increase from Q1 2024.

- PayPal’s user count has grown steadily since 2010. In the fourth quarter of each year from 2010 to 2023, the number of active PayPal accounts was 94.4 million at the end of 2010.

- Between 2010 and 2019, PayPal’s user base grew by an average of 13.9% per year, reaching 305 million accounts by the end of 2019. This was the first time PayPal crossed the 300 million mark, more than tripling its 2010 total.

- In 2020, PayPal experienced a big boost, increasing its user base by 23.6%, reaching 377 million. This was the largest yearly increase since 2010, mostly because more people started using online payment systems during the COVID-19 pandemic.

- In 2021, PayPal’s growth returned to pre-pandemic levels with a 13% increase, ending the year with 426 million users.

- However, recent data shows a slowdown in user growth over the last two years. In 2022, PayPal’s user count grew by just 2.1%, reaching 435 million, but it dropped by the same amount in 2023, returning to 426 million.

- Q2 2024 marks the second consecutive quarter of growth for PayPal, following declines from Q4 2022 to Q4 2023.

- Experts believe the drop during that time is due to the growing popularity of other payment options like Apple Pay, which has seen an increase in users, especially in the U.S.

PayPal Demographics Statistics

- PayPal Statistics stated that around 56% of people in the U.S. have a PayPal account. In the UK, about 2 million people also use PayPal.

- The number of PayPal users grew quickly during the first two quarters of 2020. In the U.S., 9% of children also use PayPal.

(Source: usesignhouse.com)

- By 2023, about 97% of PayPal users are Millennials. The age breakdown is as follows: 25-34 years old (25%), 35-44 years old (19%), and under 24 years old (14%). Additionally, 20% of users are between 45-54 years old, and 22% are over 55 years old.

(Source: usesignhouse.com)

- In Europe, 75% of people prefer using PayPal over other payment apps. Generation X (ages 40-55) are also regular PayPal users in the U.S. and have said they’ve used PayPal before.

Competitors of PayPal Statistics

(Source: statista.com)

- PayPal bought Venmo in 2012, and Venmo has grown a lot, increasing from 3 million users in 2015 to 52 million in 2020.

- Venmo is mostly used to split bills and subscriptions with friends and family.

- PayPal Statistics stated that it lets users send money and make international transfers.

- Braintree is a payment gateway that helps process online payments.

- Zettle offers payment options for small businesses, and Honey is a browser tool that helps users save money by automatically finding and applying coupons.

Profit Earned By PayPal Statistics

- In the fourth quarter of 2023, PayPal made a net income of $1,402 million.

- This is a 52.22% increase from the same quarter last year and an increase of over $382 million compared to the previous quarter.

- Here are more details about PayPal’s net income and net loss over the years:

| Quarter | Net Income(loss) | Year-on-year % change |

| Q1 2021 | $1,097 million | 1,206% |

| Q2 2021 | $1,184 million | -22.6% |

| Q3 2021 | $1,087 million | 6.5% |

| Q4 2021 | $801 million | -48.9% |

| Q1 2022 | $509 million | -53.6% |

| Q2 2022 | – $341 million | -128.8% |

| Q3 2022 | $1,330 million | 4% |

| Q4 2022 | $921 million | 15% |

| Q1 2023 | $795 million | 56.2% |

| Q2 2023 | $1,029 million | 401.8% |

| Q3 2023 | $1,020 million | -23.3% |

| Q4 2023 | $1,402 million | 52.22% |

PayPal Corporate Statistics

(Reference: capitaloneshopping.com)

- PayPal owns several subsidiaries, including Venmo, Xoom, Paidy, Honey, and others. Zettle is a PayPal digital wallet used for point-of-sale transactions.

- In 2023, PayPal had 27,200 employees around the world. Of those, 55.9% are male, 44.0% are female, and 0.07% are non-binary.

- Out of all PayPal workers, 10,200, or 37.5%, are in the U.S.

- At the beginning of 2024, PayPal had 1.07 billion shares of common stock. By the end of Q2 2023, PayPal’s stock was valued at $73.4 billion.

Conclusion

PayPal remains a top player in the global digital payments market, serving millions of customers and businesses around the world. The company’s user numbers and transaction amounts have been steadily growing. Even though it faces strong competition from other online payment options, PayPal has built strong customer loyalty, helping it successfully enter new markets.

With ongoing product improvements and growth in new regions, PayPal is well-positioned for continued success in the ever-changing digital payments world, keeping its place as a preferred online payment platform worldwide. We have shed enough light on PayPal Statistics through this article.

Sources

FAQ.

In India, 21% of people said they used PayPal for in-store payments between July 2023 and June 2024. Also, 40% of people mentioned they used PayPal for online payments during the same time.

When PayPal began operating in India, the Reserve Bank of India (RBI) noted that one of its services was cross-border money transfers. As mentioned before, money transfer services are regulated under the Payment and Settlement Systems (PSS) Act, and PayPal has not received the required approvals from the RBI to provide this service.

Saisuman is a talented content writer with a keen interest in mobile tech, new gadgets, law, and science. She writes articles for websites and newsletters, conducting thorough research for medical professionals. Fluent in five languages, her love for reading and languages led her to a writing career. With a Master’s in Business Administration focusing on Human Resources, Saisuman has worked in HR and with a French international company. In her free time, she enjoys traveling and singing classical songs. At Coolest Gadgets, Saisuman reviews gadgets and analyzes their statistics, making complex information easy for readers to understand.